The ultimate value chain series

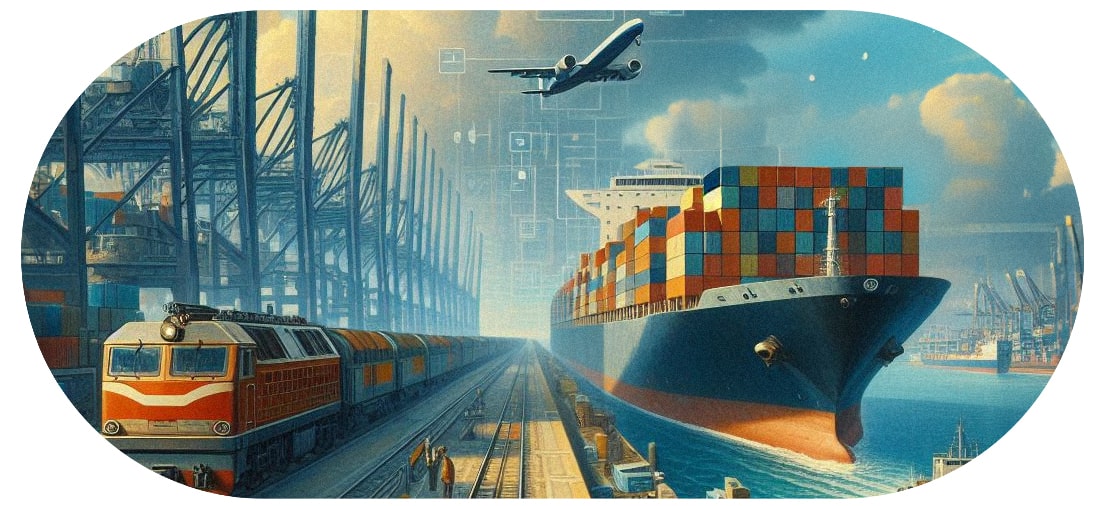

Navigating New Horizons: Reinventing Value Chains in Modern Logistics

Connection has always been the industry’s value add, and in a world that demands faster, more frequently, and in greater volumes, that is not about to change. So, what does value in the logistics chain really look like? To gain further insights into this evolving landscape, we spoke with Erik van Wunnik, Global Director of Product Development at DSV, who shared his perspective.

“I always see the logistics market as an execution of value,” says van Wunnik.

“We are moving from one value execution to another. So, in an ultimate value chain, every partner needs to add their value before it goes to the next step.”

“Because of the number of actors, most of the time there’s a lot of waste. So, to make that efficient, delivery has to be the right quantity, the right inventory has to be in place, the timing has to be right, and the transport has to be right. That in my view, would be the ultimate logistics value chain.”

That ideal leans heavily on alignment, which is itself a recurring theme in the logistics sector. Success for the modern LSP isn’t only about the execution of the logistics chain itself. It is about melding the complex needs of internal stakeholders, customers, and legal requirements – and of course the direction of the C-Suite.

Value in that sense is subjective. “For me, it starts with who you are bringing value to,” says Adam James, VP of North American Surface Transportation at C.H. Robinson. “There could be multiple answers to that. Ultimately, it’s the customer we’re focused on and trying to bring value to.

“Within that, you have to ask are the things we are doing bringing value? If they’re not, then they’re not really part of the value chain. Ultimately, the best value chain is one that brings value to your end-user. However, that value is defined by those you are targeting.”

Brave new world

The last three years have seen a steady change in consumer behavior which, alongside VUCA and climate change, are forcing markets to adjust. For those unfamiliar, “VUCA” refers to volatility, uncertainty, complexity, and ambiguity, capturing the unpredictable challenges businesses face.

As companies grapple with these dynamic shifts, their strategies, infrastructure, and operational models are undergoing a transformation.

It is, in part, to LSPs that organizations will look to facilitate that transformation. Both servitization and circular supply models, for example, are extending the lifecycle of products, while rapid delivery times make the last mile a key battleground for e-commerce players.

As an enabler in that space, there is a world of opportunity for the logistics sector to create additional value. “You want to have the most extensive asset utilization,” said a European Logistics Consultant we spoke to. “When you add services, you add value and that can be services that improve your reverse logistics, your distribution, or your warehouse management.

“Everyone is looking to improve their capabilities, and everyone will look to reduce costs, and so I think matching between supplier, LSP, and end-user will increase,” he adds. “And I think collaborations and partnerships between corporations will increase too.”

The depth of opportunity in the market is underscored by ’s move into the supply chain sector. Unlike other players in the space, it doesn’t appear to be hindered by money and is moving at lightning speed. And while Supply Chain as a Service offering won’t immediately rival more established organizations, the fact that it is creating its own ecosystem suggests that it might in the future.

How that plays out depends on how current incumbents develop their own game and where they see they can add value. For DSV, that’s about building capacity and meeting markets where they are. “We’re expanding in countries and by building warehouses,” says van Wunnik.

“We’re creating connections and we’re talking with customers to see what their requirements are. But you can only enable your customers’ needs once you have the capacity.”

This emphasizes the importance of having the necessary infrastructure, resources, and network capabilities to effectively respond to and fulfil customer needs in the dynamic logistics sector.

“There’s a lot of change. Speed to market is getting shorter and how you execute on your supply chain model is changing. You can only do that with a provider that has a global footprint. There are many parts to the value chain. For us as an enabler, it’s important to create the right offering, because then it’s not about pricing.”

Naturally, that offering looks different across the world, a notion made all the more pertinent by the diversification of the supply chain. A lot of companies are trying to figure out what that looks like, especially in North America as Mexico and Canada begin to gain more manufacturing hubs, for example.

“The question then becomes about how you should shape your distribution model or where you should have your distribution locations,” says James. “How many do you need? Our role is to help shape what that looks like for our customers and influence their thinking about how their value chain will be most effective for their end users.

“We have to help them work through the trade-offs and to decide [their approach]. The interesting thing about value is that at some point a shipper can do more than they need to, and customers don’t recognize it. They don’t recognize that value anymore, they’re not differentiating in any way, shape, or form. We have to help answer those questions.”

For whom are you creating value?

The education piece is a powerful one, and it extends beyond just creating commercial value. The collective responsibility for the environment and society means it is incumbent on the business community to influence partners and stakeholders to act in the right way.

For example, James says that many of his clients want to do better in the ESG space, but simply don’t know where to start. To alleviate that, C.H. Robinson has created a set of tools that baseline and benchmark an organization’s carbon output. In so doing it gives them something tangible to work with, a set of standards through which they can make improvements.

It’s an innovative approach to a universal problem and one that doesn’t traditionally fall under the purview of LSPs. But then, isn’t that part of what value is about? “You have to constantly challenge yourself to answer who you are bringing value to,” he says.

Sometimes, that means meeting a region or a market where it is and understanding what its requirements are at that moment in time. “You cannot digitalize the whole world, for example, because the whole world is not digital,” says van Wunnik. “We have people in warehouses in countries where there is no digital game being played. The ball game is different across the globe.”

It’s a salient point, especially in light of the speed at which both digital and environmental agendas are moving. Matching the speed of those agendas is only possible where the infrastructure is in place, be that physical, digital, or operational. In that context, it matters that companies like DSV and C.H. Robinson have a long-term vision.

“We are able to add value because of our approach,” says van Wunnik of developing regions.

“You can only move quickly when you have the capacity, but you can only do that where you have the infrastructure of people, warehouses, and partnerships. You have to develop that ecosystem.”

The consultant agrees. “The industry must be more flexible than it is and adapt quickly to the market conditions, we cannot think only in terms of standards and processes,” he says. “You have to align with the market, but that means that you need the right approaches and motivated people, you need not only standardization. The industry must invest, not just in the future, but now.”

To that end, the future of logistics lies not just in executing efficient supply chains, but in creating value for a diverse range of stakeholders, including customers, communities, and the environment. This calls for a holistic approach that balances operational excellence with innovation, collaboration, and a commitment to sustainable practices. By embracing these principles, LSPs can not only meet the current demands of the global market but also shape its future, ensuring its role remains pivotal in an ever-changing world. Exciting times await the industry.

This article is part of the ultimate value chain series. Journalist Tom Holmes and Professor Michiel Steeman embark on a journey, interviewing academics, corporations, NGOs, and various industry experts to delve into the multifaceted dimensions of the ultimate value chain.

Our Experts

Erik van Wunnik

I am the Global Director Product Development at DSV Solutions, a leading global provider of transport and logistics solutions. With over 25 years of experience in the logistics industry, I have a strong background in production and logistics management.

Learn more about Erik van Wunnik

Adam James

Adam James is Vice President, North American Surface Transportation at C.H. Robinson Worldwide, Inc. With over 20 years of logistics consulting experience, Adam James is an accomplished supply chain professional who uses analytical and process-driven approaches to establishing priorities and setting outcomes.

Learn more about Adam James

The authors

Michiel Steeman

As managing partner of Inchainge he develops and promotes business simulations on topics such as supply chain management, working capital, sustainability and circular economy. The mission is to develop value chain leaders through experiential learning. www.inchainge.com

Learn more about Michiel Steeman

Tom Holmes

Tom is a freelance supply chain journalist with 15 years industry experience. He has worked for some of the biggest names in shipping including Maersk, DNV and ShipServ, and has written extensively on a broad range of supply chain topics for a variety of publications, including Supply Management and Supply Chain & Sustainability.